As we enter 2026, expectations start afresh with a fresh year. Lifestyle is an evergreen aspect that defines the core point of human living. Clubs take the centre stage in elevating the lifestyle. Regardless of the hospitality the clubs set to provide, the operational hurdles due to fragmented systems put the services at stake, ultimately affecting the member experience. The key issues faced by the clubs in management are the financial friction, troubling members with varied payments for the clubs.

In this regard, the earlier monetary issues are the beacons of innovation & growth towards modernization. At this point, it’s obligatory for the clubs to resolve the issues through navigating strategic shifts, not just for the resolution of the toughest problems but also to sustain the club’s success for the long future. Let’s check out the key issues clubs usually face and how Northstar’s Integrated Club Management Software for Country Clubs & Private Clubs plays a vital role in providing the best club management solutions.

Major financial challenges for private clubs include over-reliance on dues, unpredictable member counts, and pointless operations in areas like food and beverage, accounting, and events. Northstar’s integrated club management software addresses these by providing an all-in-one platform that streamlines billing, automates financial processes, and offers data-driven insights through analytics to help balance revenue streams and improve operational efficiency.

The Core Financial Challenges of Clubs:

To solve operational drag, we must first understand the specific financial pressures facing private clubs today:

- Over-reliance on Membership Dues: Depending solely on dues leaves clubs vulnerable to economic shifts or sudden member attrition. Multiple income streams are essential for a club’s success.

- Operational Inefficiencies: Manual workflows in billing, event planning, and F&B lead to expensive errors and drain resources, leading to an operational burden.

- Limited Financial Visibility: Without real-time data, leadership struggles to make proactive, informed strategic decisions.

- Member Churn: High attrition rates can outpace retention efforts due to the expenses involved in the continuous member attrition processes.

- Lack of Revenue Diversification: Failing to optimize non-dues revenue streams makes it difficult to maintain stability during market downturns.

How Northstar Bridges the Gap

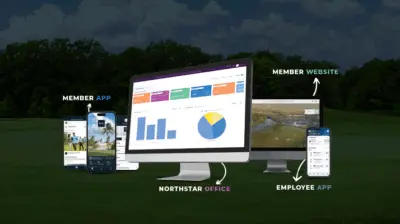

Northstar’s integrated Club Management Software is designed to replace fragmented systems with a single, powerful ecosystem that streamlines the finances moving throughout the entire club.

- Unified accounting: Automated billing, secured payments (ACH/Credit Card) with Northstar’s Accounting module eliminates manual errors. Thus, giving a clearer picture of the monetary flow, enabling the utilization of the financials efficiently.

- Revenue Diversification: Golf, Food & Beverage, events, and all the activities of the club are put together into a single view, helping management optimize profit centers beyond membership dues.

- Streamlined Operations: Enhances every operation of the club, from tee-time bookings, event reservations, shopping at the club, to Food & Beverage order-to-pay flows. And boosts both the club’s operational efficiency and member satisfaction.

- Data and analytics: Leverages Power BI to deliver real-time dashboards and analytics, allowing clubs to monitor dues-to-revenue ratios and focus on the club’s financial health promptly.

- Improved member management: Features like self-service member portals, automated renewals, and event management help retain members and make the club more appealing to new ones. Self-service portals and automated renewals simplify the member journey and improve long-term retention.

- Instant feedback: With Happometer – a member happiness measuring tool, clubs can measure member satisfaction instantly. Ensuring quick resolution of the member issues prior to the dissatisfaction leading to member churn.

Unified Accounting Solution for Clubs by Northstar

Northstar, providing a unified cloud-based accounting solution for private clubs, communities, and resorts, is a specialized software system. That combines core accounting functions with club-specific management features, such as membership and event management, into a single platform. The system integrates financial data directly from operational departments (such as F&B, golf, and point-of-sale) into the General Ledger in real-time.

Key unified accounting solutions and modules include:

- Accounts Payable (AP) & Purchasing: Streamlines vendor management, enabling electronic payments, invoice processing, and, through partnerships like AvidXchange, automates the entire AP workflow to eliminate manual data entry.

- Accounts Receivable (AR) & Member Billing: A robust module that manages member accounts, including automated dues billing, split receivables, member minimums, and finance charges.

- General Ledger (GL) & Reporting: A central hub that allows for custom journal templates, recurring/allocating journals, and virtual accounts. And built-in budgeting tools that can import data from spreadsheets.

- Real-time Inventory & POS Integration: Inventory and Point-of-Sale data flow directly to the accounting system. Thus, allowing automatic invoice generation upon receiving inventory and an immediate update of financial records.

- Analytics & Reporting: Uses Microsoft Power BI to deliver real-time dashboards for tracking KPIs, financial trends, and operational performance.

- Timekeeping & Payroll Integration: A module for tracking employee hours, overtime, and shift premiums, with the capability to interface with most major payroll providers.

- Audit & Compliance: Features built-in bank reconciliation tools and maintains PCI compliance for secure payment processing.

These tools are designed to work across the Northstar Nexus suite. Which connects the back office, member app, member website, and employee apps into a single platform for full operational visibility.

How do clubs benefit from Northstar’s Accounting Module?

Northstar’s Club Accounting is a single-database architecture that unifies back-office financials with front-end operations like POS and reservations. This “single source of financial data” eliminates the need for manual data syncing between departments.

Key Benefits for Private & Country Clubs

- Operational Efficiency: Automates routine tasks like membership renewals, failed-payment recovery, and invoice processing, significantly reducing administrative manual work.

- Real-Time Financial Visibility: Because every transaction from a pro shop sale to a dining reservation updates the General Ledger instantly, leadership can make informed decisions based on current data.

- Enhanced Member Experience: Members can easily view statements and track preferences. And pay dues or guest fees via a branded mobile app or secure Online Member Portal.

- Reduced Errors & Fraud: Direct integration with partners like AvidXchange for accounts payable enables paperless, electronic vendor payments, reducing manual data entry errors and fraud risk.

- Integrated Inventory Management: Enables a seamless transition from inventory receiving to the General Ledger. This ensures that stock levels and associated costs are always accurate.

- Advanced Reporting: Finance managers can use Power BI-driven dashboards to track KPIs. And compare revenue across various departments (e.g., F&B vs. payroll costs) in real-time.

Moving from fragmented systems to a consolidated platform. Many clubs have reported a shift from “chaos” to a unified environment. Hence, staff spend less time on data entry and more on higher-value member services. Here’s what Grove XXIII Club has to say about Northstar –

“The Northstar software really has a lot of parts to it that actually all integrate very well together. So it’s more of a one-stop shop where you can get all of your POS information, your accounting information. We have cottages with rooms, and everything integrates really well and produces great financial reports.” – Kerri Milan, CFO, Grove XXIII Club

How is Northstar a value-based alternative to its competitors in the Market?

While the Northstar’s competitors are also major industry players, Northstar’s “unique” standing in the market is often positioned on specific attributes such as –

Single Source of Financial Truth

Unlike systems that rely on separate modules “talking” to each other, Northstar’s club accounting is natively unified with

- Real-Time Data Flow: Transactions from Food & Beverage (F&B), Pro Shop, or member dues flow instantly into the General Ledger without manual batching or export/import processes.

- Unified Member Records: All financial history from a single dinner reservation to annual dues is housed in one record, providing a 360-degree view of member spending and financial health.

Deep Integration with Modern BI

Northstar leverages Power BI within its analytics module to create real-time financial dashboards. This ensures CFOs and Controllers to track KPIs and trends across all departments (Golf, Spa, F&B) in a single visual interface. Whereas some competitors may require external reporting tools or custom exports to achieve the same level of granular insight.

Automated Accounts Payable (AP)

Northstar offers a specialized integration to automate the back-office AP process. This allows electronic invoice intake, routing, and approvals directly within the workflow, reducing manual data entry errors and fraud risk.

Are you looking to empower the Clubs for 2026?

Don’t let financial complexity hinder the club’s potential. By centralizing the club’s operations with Northstar, gain a total financial picture that turns data into actionable growth. Request Demo and ensure the club’s financial control with a complete club management software.