How to keep the lifeblood of your club flowing with your accounts receivable system

By Srishti Singh

Let's face it. If we think of a business as a body, then cash flow can be thought of as the blood. It's accounts receivable we rely on to get those needed cash infusions from customers to keep the body going.

Accounts Receivable is your invaluable tool to regulate cash flow.

It's common to think of the accounts receivable function as just something for the bean counters in the basement. But it's a fact that the entire club needs cash flow for day-to-day operation.

That needed cash flow is provided by member dues, house charges and ancillary fees. Accounts receivable ensures that cash keeps flowing.

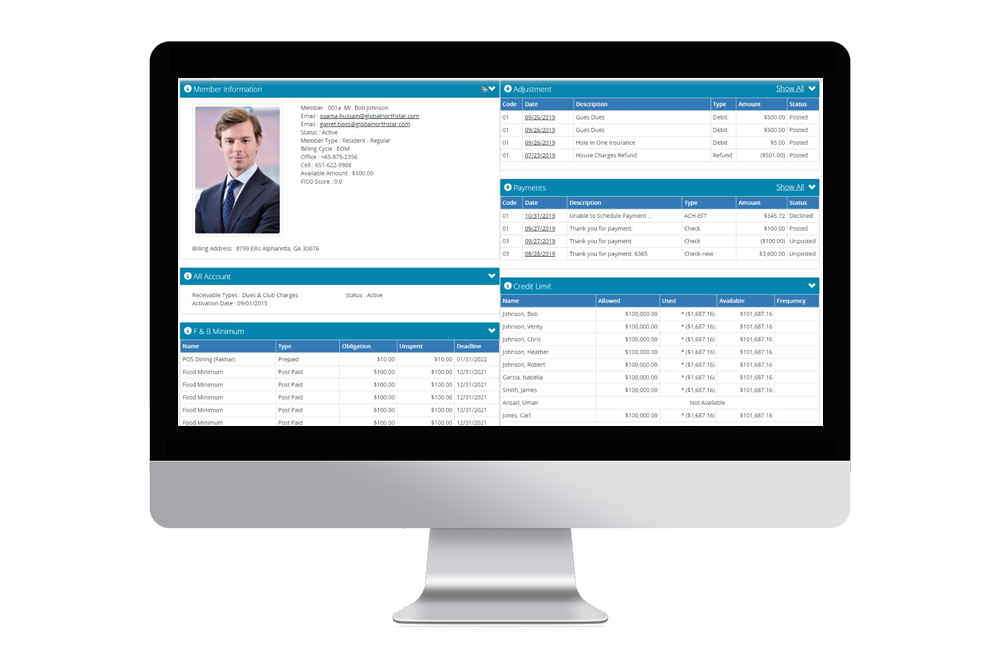

Premier clubs know that the accounts receivable function, done right, makes business run smoother. An agile, responsive accounts receivable process can easily identify customers who have not paid or whose payments have been declined. And it can start the amelioration process quickly, whether that is by deactivating a membership, by charging an additional fee, or by some other mechanism.

But it can be much more than simply a punitive tool. In fact, the right system can inspire customer loyalty.

Clear and concise communication. Ease of use. Automated payment options. Flexibility in payment mechanisms and in scheduling. These are just some of the ways in which accounts receivable eases the payment process for members, resulting in increased satisfaction.

Seamlessly integrate with the member website or app for ease of use

We live in a busy time, and it can be easy for members to lose track of what's owed. This is where integration with the member website and the club mobile app (and underlying database) becomes so valuable.

With this integration, members can see upcoming payments or past due amounts on the website or the mobile app. They can add in a payment method and make a payment. They can even use the app or website to see past statements or to communicate with the accounts receivable department.

If they have a dispute, they just click on the item and use a simple intuitive process to file the dispute. No waiting on hold to talk to someone. Once filed, they can get back to enjoying the club amenities until the issue is addressed.

Automation and integration can ease the burden and empower your staff

Having the accounts receivable process integrated with the website and mobile app as well as other systems eases the burden for your staff. For instance, dunning is a detested necessity in business. A report or trigger can be designed that notifies staff that a user is in arrears. With a few clicks, a prepared dunning script can be sent. Alternatively, if a personalized notice needs to be delivered, the staff member can compose the note and have it delivered through the website or app.

Other process automation could include:

- Deactivation or activation of members based on predefined rules

- Preparation of EOM (end-of-month) reports

- Creation of periodic reports on categories you define

Along with this functionality, a premier system will allow users to create their own customized reports. For example, you may want to get a view of top and bottom spenders by membership category. Or, identify where the majority of spending is concentrated by membership category.

All this functionality helps the staff generate new insights to help improve operations. And it frees them to work on other critical issues at the club.

Unlocking additional functionality with an integrated accounts receivable system

Integration of accounts receivable keeps things running smoothly. As we noted, it can reduce the need for dunning, or in the worst cases, deactivation of membership. Plus there's other functionality that can benefit both staff and members. This includes:

- Allowing members to choose the day of their payment

- Securely storing ACH account or credit card info for automatic charging – alleviating staff from running hundreds of credit cards

- Giving members the ability to pay easily, and immediately crediting the payment to their accounts, allowing immediate resumption of services in the case of membership deactivation

- Change Automation – If members change their tier of membership, this could involve changes in monthly benefits or the dues assessed. Having the system automatically update and send communications to members reduces the possibility of confusion or a misunderstanding.

Make your accounts receivable function do more for you and your business.

A smart, integrated accounts receivable system can become a formidable tool for keeping accounts current and members out of arrears. It can also prove itself as a labor saving device. Think of those countless hours chasing down delinquent accounts. Now, with a process in place, this can be a simple task that allows staff and members to be aware of the issue long before it could become a problem.

Most of all, it can prove to be another method for delivering more convenience to your members. Whether that's giving them more options for making payments, allowing them to easily communicate with the A/R department, or handling disputes. It's the kind of tool that can give accounts receivable a hand in improving the member experience.

Northstar Technologies can streamline your accounts receivable function by integrating it into a complete club management platform. A premier platform built on one database to give your entire operation a single source of truth for better decisions for the club. And a better experience for members. Get a view of what it can do for you – request a demo, today.